How to Proceed with Your Next Real Estate Decision

2023/4/3

Do you feel frozen lately? Not because of the winter weather, but because you don’t know how to proceed with your business or financial decisions? This is the only way I can describe how I am responding to the current economy. On the one hand, I see the rising interest rates. On the other, I see the data from National Association of Realtors (NAR) that sales are up (Pending Home Sales Grew for Third Straight Month, Up 0.8% in February1). On the one hand, I see increases in inventory. On the other, I see access to lending down.

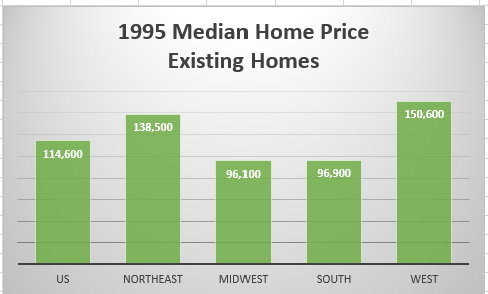

We can only make our financial decisions based on historical data and our own experiences. When my husband and I were starting our family in 1994, we bought our first home for $160,000. This was slightly above the median sales price for single family homes in the West I was not interested in historical data. I only knew we needed a house, and this was the best choice for us at the time. We knew our home would not lose value and, worst case scenario, we could always sell and hopefully make a profit.

Copyright 2017 “Existing Home Sales Historical Data (2022)-Download.” National Association of Realtors. All rights reserved. Reprinted with permission. April 4, 2023, https://www.nar.realtor/research-and-statistics/housing-statistics/existing-home-sales

When I start to feel like everything is so expensive and the next generation can’t possibly manage the current economy, I have to reflect on how we managed. My parents were utterly shocked to see us pay so much for such an average home. Admittedly, we were reaching a bit because we wanted to grow into the home.

We also bought with zero money down and at a 9% interest rate. Buying with no money down has not been as common during the buying frenzy of the last few years. Buyers simply have not had the time to deal with the financing requirements because they have been competing with multiple offers.2 When Redfin researched data from county records, they found that 30% of buyers in 2021 bought with cash.3 Whether these situations will change with the slowing real estate market remains to be seen as the access to money has been complicated by the recent banking scandals. Even the rise in new home sales could be thwarted by the recent bank failures because builders will find lending dry up.4

Still, we have some serious problems in our economy that cannot be glossed over by introspection. We are enduring some policies that are counterintuitive to responsible fiscal behaviors. While we can look back on data to help assure our next decision, we must also be prepared to navigate difficulties ahead.

- Pending Home Sales Grew for Third Straight Month, Up 0.8% in February, https://www.nar.realtor/newsroom/pending-home-sales-grew-for-third-straight-month-up-0-8-in-february↩

- More Homebuyers Making 20% Down Payments and Waiving Appraisal and Inspection Contract Contingencies, https://www.nar.realtor/blogs/economists-outlook/more-homebuyers-making-20-down-payments-and-waiving-appraisal-and-inspection-contract-contingencies↩

- Share Of Homes Bought With All Cash Hits 30% For First Time Since 2014, https://www.redfin.com/news/all-cash-home-purchases-2021/↩

- U.S. New Home Sales Rise for the Fifth Consecutive Month, https://www.realtor.com/news/real-estate-news/u-s-new-home-sales-rise-for-the-fifth-consecutive-month/↩